At Nipun, one of the core tenets of our investment philosophy is that in the long term stock prices are tied to fundamentals and in the short term investor sentiment can push prices away from fundamentals. Being successful in Emerging Markets requires an ability to measure both these pieces, fundamentals and sentiment. In this piece, we take a very long-term view of fundamentals and highlight how Emerging Markets are changing.

Emerging markets have been a key driver of global GDP growth for the last decade and that is likely to continue for the foreseeable future. Despite the economic slowdown in China and increasing trade restrictions with the U.S., China is still projected to contribute more than one-third of global GDP growth this year.

China will contribute 1/3rd of global GDP growth in 2023

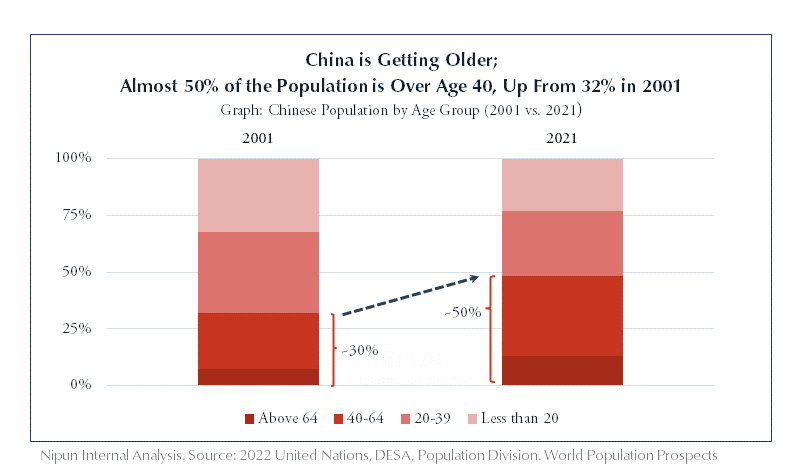

China has long been the face of Emerging Markets – the most populous country in the world with supportive demographics that contributed to growth over the last few decades. Now, China is getting older. Almost half of China’s population is above 40 years of age, up from 32% in 2001 (as shown in the chart below).

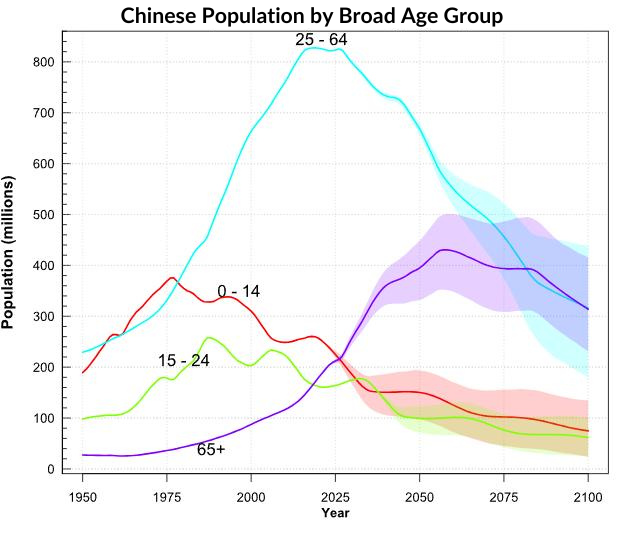

The total population in China is declining and the working age population is declining at a much faster pace.

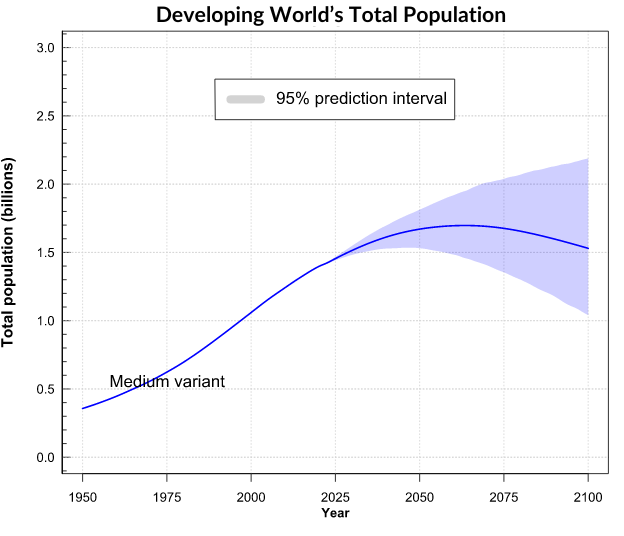

In contrast, the rest of the developing world has stayed broadly similar over the last two decades.

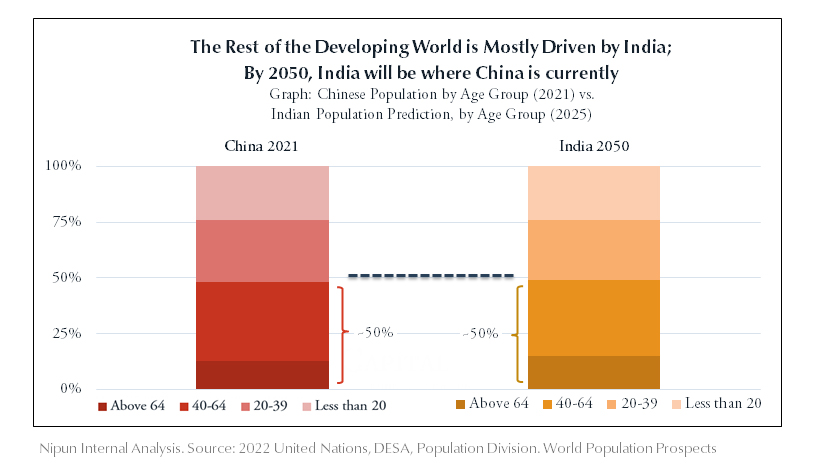

The demographics in the rest of the developing world are mostly driven by India, a young country with a growing population.

By 2050, India will be where China is today, reaping the benefits of a young and growing workforce.

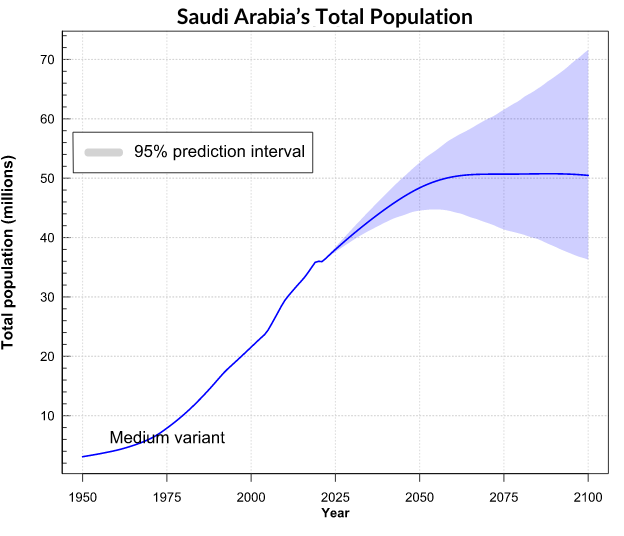

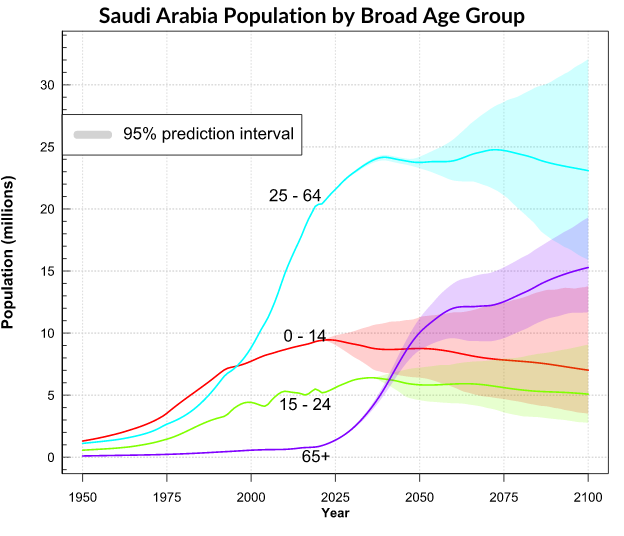

Beyond India, EM investors tend to focus on Indonesia, Brazil and Mexico when evaluating opportunities linked to demographics. A smaller, under invested and often overlooked country is Saudi Arabia, with a current population of about 32 million. The combination of an increasing number of expats and a naturally high birth rate (coupled with a low mortality rate) has resulted in an annual population growth of 2.5% on average. Astonishingly, the median age in the country is 29 and over 60% of Saudis are below 30 years of age[1]. Given the high growth and the young population, the cohort of working Saudis is likely to stay stable or increase for the next 50 years. This makes it unique within Emerging Markets.

Cohort of working Saudis is likely to stay stable or increase for the next 50 years

Realizing the opportunity, the Saudi Government launched “Vision 2030”, an ambitious program to grow and diversify the economy. Its still early days of this program but the progress so far has been strong including social reform, capital investment and job creation.

This is just one example of the opportunities that abound in Emerging Markets. Emerging Markets have witnessed immense change since the over the last 50 years – think back to the days of the “Asian Tigers”, the rise and selective demise of the BRICs and the phenomenal rise of China to rival U.S. as a superpower. The next 50 years are certain to bring just as much change, in part spurred by the changing demographics of the region. Amidst this change, lie opportunities.

For further discussion, please contact Nipun Investor Relations at nora.cheung@nipuncapital.com.

[1] https://www.reuters.com/world/middle-east/saudi-population-322-mln-median-age-29-years-old-general-authority-statistics-2023-05-31/