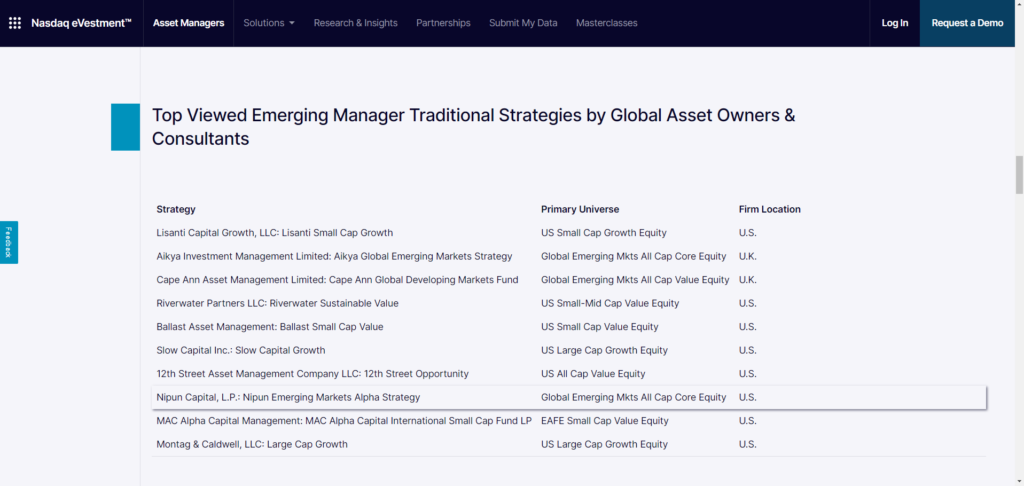

Listed by eVestment, A Nasdaq Platform

Top Viewed Emerging Manager Traditional Strategies by Global Asset Owners & Consultants – 22 January 2024

Primary Universe: Global Emerging Mkts All Cap Core Equity

Nipun Capital, L.P.: Nipun Emerging Markets Alpha Strategy

“Well before adjusting allocation models or approving manager searches or replacements, asset owners and their consultants conduct extensive research in Nasdaq eVestment™. Therefore, this research activity serves as a leading indicator of how institutional assets are likely to move in quarters to come. Managers use this data to quantify interest in their products, evaluate their brand visibility and continually improve their database marketing strategy.

Based on global consultant & asset owner viewership in December, 2023. Products must be classified in Nasdaq eVestment’s™ All ESG-Focused secondary universe for inclusion in the ESG list. Newly added products are those that have been added to the eVestment database in the last 180 days. An emerging alt/hedge fund is defined as having a firm AUM of <$500MM USD. An emerging traditional firm is defined as having a firm AUM of <$2.5BN USD.”